Economia

Central Bank or Treasury Department -- Who is responsible for the current surge in prices in Brazil?

Central Bank or Treasury Department -- Who is responsible for the current surge in prices in Brazil?

Translation: The

media blames the recent price hikes in Brazil on the uncontrollable spending of

the Ministério da Fazenda (Treasury Department). In order to restrain this frivolous

expenditure, the Banco Central (Central Bank), always active and vigilant,

would be immolating its popularity in an inglorious fight with the intrepid

Guido Mantega, by raising interest rates to counter the surge in prices caused

by the spendthrift "manteguistas", sacrificing the popularity of the

institution and the Government itself -- all for the good of the country.

Government Spending

At first glance, the media's stance on this issue seems to

make some sense. After all, Government

expenses do in fact provoke price inflation.

When Government spends, it is consuming goods which would have otherwise

been utilized by the private sector or entrepreneurs towards more productive

and useful means. Goods that would be

available to the population end up being consumed by the Government. Consequently, Government spending reduces the

amount of resources available to the population.

If Government spent less,

1) There would be a higher amount of goods available to consumers who need them with more urgency than the Government;

2)

Industries would not need to employ resources

only to supply the scarcity of such goods (a scarcity caused by the

Government), instead permitting investments in new methods of production

resulting in a larger abundance of goods available;

Therefore, Government spending makes it that less of these

goods are made available to the private sector, raising their costs and,

consequently, harming the poor.

Government spending also forces industries to reallocate their resources

towards the production of those goods consumed by Government, impeding the

investment in, and the expansion of, other production processes. In the end, the expenses of the Government

also impede that these goods consumed be employed towards more productive means

by the private sector, which could also generate benefits to other parties.

It is soon clear that Government spending inevitably

stimulates price inflation and all condemnation towards this action will always

be welcomed.

Nevertheless, there exists a small problem; this is where

the media gets lost. The rise in

Government spending is only possible via the existence of a Central Bank which

may create money out of thin air. Absent

a Central Bank, it would be impossible for Government to raise its spending

continuously, as does the Brazilian Government.

Therefore, the Brazilian Central Bank, instead of being a warrior

against price inflation and the senselessness of the Ministério Da Fazenda (Treasury

Department), is above all its purveyor and protector. The Ministério Da Fazenda (Treasury

Department) can only spend disproportionately due to the existence of a Central

Bank. It is soon apparent that the onus lies

on the Central Bank and not the Treasury Department for the recent surge in

prices in Brazil.

Guido Mantega

Prior to explaining the reasons behind the culpability of

the Central Bank, we will have a short commentary on Guido Mantega.

In early December of last year, I wrote a small passage on our blog

commenting on the inexplicable respect enjoyed by Guido Mantega with the

press. It did not matter what

absurdities were said by the man ("Inflation is under control and will not

exceed our target"), the media's subservience to his statements was always

present, conferring in him areas of great knowledge to the nonsense which he

uttered ("We can remain calm as a reduction in food prices will occur in the

beginning of 2011. We have seen this

story play out before").

A prominent magazine, touted as oppositionist, has even

glorified him as a "great captain" steering the economy into a new era of

"responsible social development" created by the Lula administration, a healthy

and necessary change in relation to the "insensitive social austerity" of the

Palocci era. No criticisms were directed

towards this distinguished gentleman, Guido Mantega.

Apparently, anyone can be exalted when times are good. The moment that the ship begins to take on

water all reverence is removed and all fingers are pointed towards the captain,

accusing him of conducting the embarkation in an imprudent manner during the

entire voyage -- he, who was always seen as the great beacon of temperament and

modernity.

This shift in posture, despite all of this, is great

news. A nation can only aspire to obtain

integrity when its men of public office become discredited by the media. It is however easy to vilify Guido Mantega,

despite his natural astuteness, he possesses a physique du role for such criticisms. Precisely for lacking an understanding of

what is happening in the economy, his ignorance and deer-in-the-headlights look

on his face is in itself a grotesque spectacle.

He may be inept, but is otherwise not guilty. The real revolution will occur on the day in

which the truly guilty party -- the bureaucrats running the Central Bank --

receive the same harsh criticism.

Why the Central Bank is pernicious

If you open up any

Macroeconomics textbook, you will learn that the function a Central Bank

provides to a country is a safe, flexible and stable financial and monetary

system -- or a similar explanation.

However, such an

explanation is not only false, but the complete opposite of reality. In other articles of this site,

the fact that the monetary supply of an economy does not need to be either

manipulated or altered has already been discussed. Money is simply a medium of exchange which

facilitates indirect transactions. A higher

quantity will simply dilute prices and redistribute the income in favor of

those people or companies which are the first recipients of this new

money. There is no set quantity which to

follow, any quantity works in the long run.

Understanding the

above, let's clarify the real function of the Central Bank, the one not found

in university approved textbooks.

The Central Bank --

being in Brazil, USA, EU, Chile or in Australia -- possesses two major

functions:

1) Protecting the banks -- forming a banking cartel that discourages competition -- and bailing them out in times of financial insolvency; and

2) Finance the Government's deficits

Item number one is the easiest to comprehend. The banks operate on fractional reserves, which essentially means they loan more money than what was deposited in their vaults. In other words, banks have the power to create money. This money created by the banks out of thin air -- a digitization of money, for which there exists no corresponding amount in paper or physical coins -- is called fiduciary media. It is this which is utilized as payment through checks or debit cars, but it does not possess a corresponding value in physical money inside of the bank's coffers.

In this fractional

reserve scenario, in the absence of a Central Bank, there would exist the risk

of an uncoordinated expansion of credit.

The most expansionist banks -- those who created the most money -- run

the risk of losing reserves to the less expansionist banks. If Itau creates

more fictitious money than Bradesco, the fiduciary media of Itau will

inevitably fall into the account of a Bradesco member. If this persists, Bradesco will request, at

the end of the day, that Itau make good on the amount credited, sending a

corresponding amount in money (in this instance, paper or metal coins),

resulting in a loss of reserves for Itau.

In the extreme case that Itau enormously expanded its credit and

Bradesco had adopted a more conservative posture, Itau could completely be

wiped of its reserves, going into bankruptcy.

It is at this precise

point where the Central Bank comes in.

It can "supervise and control" the credit expansion -- plainly,

harmonize the expansion, making it so that all banks create new money at the

same rate. If all banks expand credit at

the same rate, the risk of bankruptcy will not materialize because one bank

created more money than another. When

all banks simultaneously expand credit, the amount of fiduciary media of Bank A

that ends up in Bank B's account is practically the same that goes from B to A,

such that during settlement, they cancel each other out. Such an arrangement permits that banks

maintain less money in their reserves than they otherwise would in case there

was no Central Bank. In other words,

this arrangement increases the capacity of banks to create money out of

nothing, consequently raising their profits.

This results in high profits without the risk of insolvency.

Therefore banks

vehemently defend the existence of a Central Bank. It is the Central Bank that forms and

coordinates this cartel, creating a barrier to entry for competing banks that

could affect this delicate equilibrium.

Without a Central Bank, there would be no coordinated expansion of

credit, for there would always be the risk of one bank leaving the cartel and

demanding its compensation of fiduciary media, and with that, sending its

competitors to bankruptcy. In order to

have any coordination, banks must form a cartel. To coordinate this cartel, to discipline

"rebel" banks, a Central Bank is necessary.

Ergo, a Central

Bank allows banks to expand their credit without the risk of insolvency,

excessively raising the profits of this sector.

As an additional benefit: in case there is a bank run, or a bank becomes

insolvent because it engaged in bad loans, the Central Bank can create money to

bail it out. This guarantee stimulates

banks to expand their credit ever more, thus generating economic cycles.

However, this still

is not the principal function of a Central Bank. Up to this point we have only been discussing

the relationship between banks and the Central Bank. Nevertheless, the Central Bank is a

Government entity. It is soon apparent

that its primary function is to tend to the immediate interests of the Government. This is exactly what happens.

You will seldom

hear this from the mouths of academic economists, for this is the reality: The Central Bank exists primarily to

finance Government deficits.

Nonetheless, this

scheme is not so obvious at face value. The

Central Bank does not simply create money and funnel it directly to the

Government. In truth, this occurred

until the mid 1990s. During that period,

the Government sent the Congress a proposal requesting authorization for the

Central Bank to print a determined amount of money to cover the budget deficit. And Congress always approves this

request. It was that simple: The Government collected $1,000 in taxes, but

wanted to spend $2,000. What was the

solution? Print the difference. After price inflation reached a few billion

percent, the geniuses finally woke up to reality. In 2000, with the Fiscal Responsibility Law,

this type of direct financing was prohibited.

Today, the Central

Bank does not print money and deliver it directly to the Treasury. Even though in practice this is exactly what

the Central Bank continues to do, it is now done in an indirect manner. This is the ingenious trick which no one

takes into account.

It works like

this: when the Central Bank wants to

expand the monetary base, it needs to engage in what is referred to as open

market operations -- which is, the Central Bank purchases Government Bonds

which are held by other banks.

Explicitly stated, the Central Bank creates money to purchase these

bonds that are held by the banking system.

Currently, this is the only legal manner in which the Central Bank

creates money.

How does the

Central Bank do this? Crudely, it

presses a button in a computer and adds a few digits to the account (the

required reserves) of the bank that is selling the bonds it possesses together

with the Central Bank. Where does this

money come from? It came from

nowhere. The Central Bank created it out

of thin air. No other account was debited. The monetary base magically expanded; the

reserves of this bank increased.

Now, imagine that

you are a banker. You, due to fractional

reserves, can create money out of nothing and utilize it for a particular

investment. You also know that the manner

with which the Central Bank creates money is through Government Bond purchases

which are in its possession. It is not

necessary to be a financial genius to realize that the most obvious and safest

investment which you can make is precisely to purchase the Bonds which the

Treasury puts up for auction. In other

words, you happily finance the Government deficit, because you are well aware

that these Treasury Bills which you will purchase from the Treasury will later

be bought by the Central Bank, for it is how its monetary policy functions.

In precisely

knowing that these Treasury Bills will be bought by the Central Bank -- which

means that they possess a high-liquidity re-sale market --, that banks merrily

finance the Government deficit. In other

words, that which was directly done before -- with the Central Bank giving

money directly to the Treasury -, is now done indirectly, with a caveat: now banks are a part of this arrangement and

profit enormously from it.

The arrangement

seems scandalous, and it is. However,

since only a few people understand it, no one makes a fuss about it. In the meantime, in the USA, things are

becoming different. With the financial

crisis of 2008, the ridiculously large bail out packages given to the banks,

and the subsequent widespread popularization of the ideas of the Austrian

School of Economics, which condemns these actions, the people there are finally

starting to understand this arrangement, and the Federal Reserve in under

constant attack and criticism at the moment. Never before has a Chairman of the Fed been

the target of so much mockery as Ben Bernanke, and there currently exists a

civil movement calling for the abolition of the Fed. One day, we will reach that point here.

Therefore, it is

worth repeating the conclusions of this section: the Central Bank possesses two

functions: cartelize the banking system,

safe-guarding it from competition and guaranteeing high profits, and finance the

Government deficits -- this being its principal function. The Central Bank does not directly give money

to the Treasury, but guarantees that it will buy the bonds which are in

possession of these banks. In this

manner not only does the Central Bank stimulate the financing of Government deficits,

but it also encourages wreck less spending.

This brings us to

our final section.

Why the Central Bank is more pernicious than

the Treasury Department

It is not the

intention of this article, as stated in the beginning, to pardon Guido Mantega

of anything. Government spending should

always be condemned regardless of the occasion, for they destroy resources and

in fact generate price inflation.

Therefore, in the absence of a Central Bank to finance these expenses,

it would be impossible for there to be a steady rise in prices as it is happening

now. Ergo, the real guilty parties ought

to be exposed.

The current price

inflation in the Brazilian economy is mainly attributed to the expansion of the

monetary supply, caused by the Central Bank.

One of the causers of this expansion of the monetary supply is the

Treasury Department, as it will be shown below.

All the pertinent details of how the expansion of the monetary supply

generates inflation have been exposed in this article, in a

manner which does not need repeating.

The intent here is to show why, without the Central Bank, Guido Mantega

would be incapable of maintaining his spending binge.

When Guido Mantega

decides to spend more than the Government collects in taxes -- which is exactly

what he has been doing, given that the Government is incurring consequent

nominal deficits -, the Treasury sells Bonds to collect money to cover this

deficit. In the same way, when Mantega

decides that the BDNES should give subsidies to the Government's favorite

companies, the Treasury sells Bonds to collect money to be distributed to the

BNDES, which will then re-distribute it accordingly to the related enterprises.

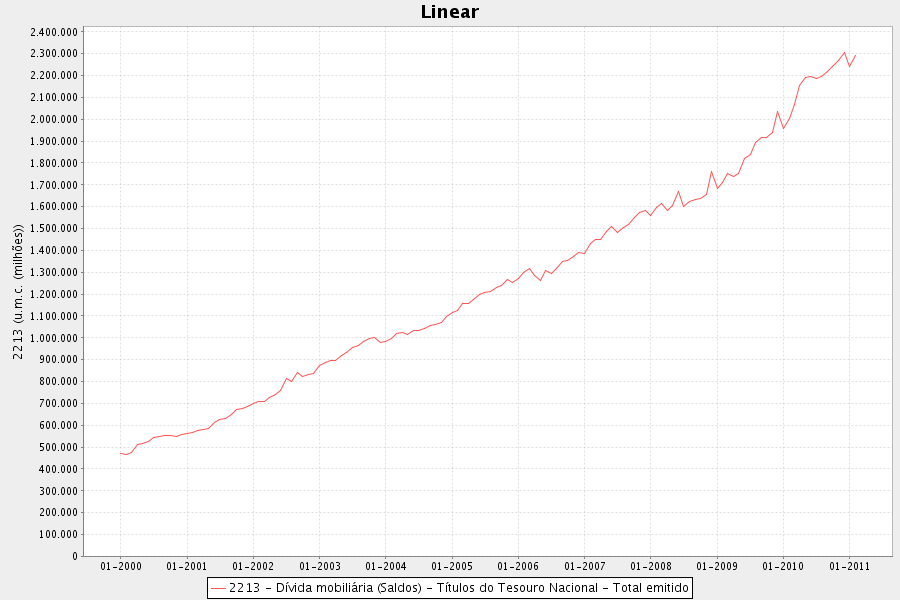

The below chart

represents the jump in the public debt -- total Bonds sold by the Treasury to

finance Government Spending -- since 2009, rising no less than R$ 600 billion

in only 2 years.

And just what is the consequence of all this? This rise in the sale of Bonds signifies a

rise in the Government's demand for more money from the banking sector --

which, as aforementioned, merrily finances this party. With more money flowing to the Government,

the baking sector ends up with less available for loans to the private

sector. Additionally, this also makes it

so that the amount of available money for the interbank market (where the banks

loan to each other with the sole intent of maintaining their reserves at levels

stipulated by the BACEN (Central Bank of Brazil)) remains smaller, for now

there is money being demanded from all sides (Public and Private Sectors).

In this scenario, in case the Central Bank did nothing, the

tendency would be that the interbank market's interest rates would rise

considerably. And the interbank market's

interest rate, as it is known, is nothing more than the SELIC (Special

System of Clearance and Custody). Seeing as if the BACEN

works directly with the SELIC towards a target rate, it cannot allow for rates

to rise. Consequently, it has to inject

money in the interbank market just to prevent rates from rising too much.

In

other words: on one hand, the Government

borrows money from the banks, which tends to raise the SELIC; and on the other,

the Central Bank injects money into the banks, to prevent the SELIC from

rising. This is the way it works.

In some

months past, the Central Bank injected a quantity that was sufficient enough to

prevent rates from rising too much.

Today it has to inject an even greater amount just to maintain the rate

within the stipulated target (currently set at 12%).

And

just like that we arrive at the current phenomenon: The Government, incurring

huge costs, is each time absorbing more money from the banking sector, which

puts pressure on the SELIC.

Consequently, the Central Bank has to continuously inject money into the

banking system just to prevent the SELIC from rising. If it had not done anything, the SELIC would

have been rising for a long time now.

Hereupon,

Guido Mantega, in raising the amount of money which the Treasury borrows

together with banks to finance its expenses, is provoking and expansion of the

monetary supply. Therefore, the one

entity which is allowing for this expansion is precisely the Central Bank. If the Central Bank ceased to print money and

allowed the SELIC to fluctuate according to the supply and demand of money in

the banking sector, as soon as the Treasury sold Bonds to the baking system,

the quantity of available money in the interbank market would be reduced --

immediately raising the SELIC. If it

were to continue with this behavior, the interest on servicing the debt would

be astronomical and the Treasury would simply not be able to maintain this type

of financing. There would not be enough

money to satisfy the wishes of the Treasury Department.

That

is, everything that the Central Bank needs to do is to cease printing money

and, consequently, stop fixing the target for the SELIC. In doing so, Guido Mantega would immediately

be unable to continue his party. All

that Alexandre Tombini needs to do is to publicly denounce the Treasury

Department's actions. The fact that he

does not do this only shows that not only is he evading his obligation as the

"guardian of the currency" (with large doses of irony), but also fomenting its

own destruction.

Conclusion

Therefore, to

conclude: the Treasury Department's

behavior is the cause of all monetary inflation -- and, consequently, price

inflation. Nevertheless, such behavior

only occurs with the complete acquiescence of the Central Bank -- the entity that

facilitates this entire mess. Curiously

enough, the press does not broach the subject in such a manner. It instead paints a picture of a villain and

a hero, when in truth there are only two villains happily working in collusion

with one another.

In theory, all that

is necessary is for the Central Bank to turn off its printing presses and

Mantega becomes powerless. However, this

is not in the best interests of either the Government or the banks. There is nothing that can be done while this goes

on.

Merely protect your savings. The purchasing power of your money is being transferred to the Government, to the banks and protected companies.

Translated by David Klein

Comentários (0)

Deixe seu comentário