Renationalization of credit

Russia, with its oligarchs and their close links with the government, and China, with its hundreds of state-owned-enterprises, are already notorious for this version of capitalism. So are the oil-and-gas rich middle eastern sheikdoms.

But Brazil, a democracy with 200 million inhabitants, could leave one wondering if the country indeed deserves to be part of this select team of state capitalists. The fact of the matter is, and as correctly pointed out by the British magazine, the Brazilian government too succumbs to the temptations of the visible hand of the state.

Be it by acquiring minority stakes in several companies through BNDESPar (the national development bank's private equity arm), by granting subsidized loans to chosen winners (also through BNDES), or by wielding controlling power in mega private corporations like Vale (through significant shareholding positions from the mighty public pension funds), the Brazilian Leviathan is far from sleepy.

This introduction brings us to the topic at hand, namely, the development of credit in Brazil, and, as our title suggests, how the state isn't leaving it solely to the market to decide the channeling of funds. But before we proceed, it is worthwhile to revisit the recent history of public financial institutions in Brazil.

State-owned-banks and banks owned by the states

No longer than 15 years ago, 23 out of the 25 states of Brazil possessed its own bank. Founded after World War I and throughout the XX century, under the pretext of providing long term financing when the private banks would refuse to lend (or were unable to do so due to high inflation and/or government excessive borrowing), these banks ended up causing severe fiscal and monetary hardships in the country.

Banespa, for the state of São Paulo, Banerj in Rio de Janeiro, Baneb in Bahia, Credireal in the state of Minas Gerais, and Banestado in Paraná are a just sample among these public financial institutions. Brazilians will surely reminisce about these infamous names.

In theory they were all meant to develop their regions. In practice the reality was entirely different. Infinite loans were made to their own controlling shareholders, the states themselves, whenever tax revenues fell short of covering public expenditures. The several state enterprises in the telecom, water & sewage, roads, and transportation sectors were also often recipients of state bank credit. Unsurprisingly, these loans regularly turned sour. But their "credit worthiness" remained intact, as more loans were granted, and old ones were either renegotiated or simply written-off.

In the end, the majority of state banks were frequently in a state of insolvency. The Brazilian central bank (Bacen) had to constantly bail out these institutions, as many were already considered "too big to fail". The peak of this chaos took place within the 80s and early 90s, and it was a major contributing factor to the hyperinflation episodes the country experienced in those years.

What about credit? What about long term credit? Did the banks owned by the states indeed contribute to the development of its respective regions, following its main pretext for existence? One has a hard time answering the last question on the affirmative.

With regards to credit one can surely say they fulfilled the mission to provide funding. Long term credit. Short term. Any term. Large and small. Absurd and bizarre. To their own shareholders. To their shareholders' enterprises. To worthy and unworthy borrowers alike. It was the inevitable outcome of a state run bank with pervasive conflicts of interest, poorly managed, driven not by profit, but by political motives.

From '88 up to the introduction of the Real (July '94), public financial sector credit averaged, not surprisingly, 64% of total credit outstanding. After all, how can a private bank outcompete a public bank extending credit recklessly.

The country soon reckoned credit cannot be created out of thin air and regardless of prior savings. Unworthy borrowers are deemed "unworthy" for a reason, that is, the financial inability to service the debt.

With the transition to the new currency, the Real, there soon came the need to completely restructure the state banks. A 1996 legislative piece marked the start of this process, in which the Ministry of Finance instituted the "Proes" (Incentive Program to Reduce the State Presence in Banking). Its goal was to either liquidate, return to solvency, and/or privatize the state banks.

By the end of the program in 2002, after nine bank privatizations and many liquidations, public financial sector credit meant no more than 38% of total outstanding credit. Why didn't it decline further? Well, some important state banks remained in operation, like Banrisul and BRB (Bank of Brasilia).

Though market practices were adopted (Banrisul even listed in the Bovespa), they are, in the end, controlled by the states, and thus, driven by political motives. And so are the federal banks, Banco do Brasil and Caixa Econômica Federal (CEF), and the national development bank, BNDES. These gigantic financial institutions still shape a considerable portion of Brazil's economy to this day.

This leads us to our next section, where we venture to gain some insights into the development of credit.

"Official" credit gaining momentum

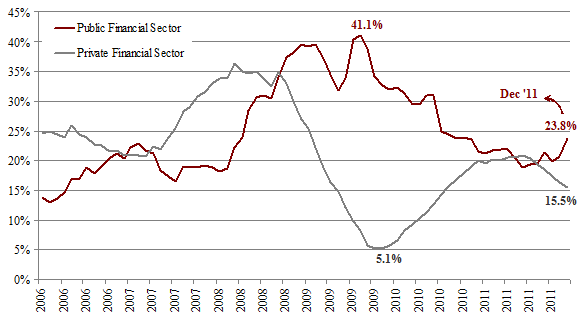

Analyzing Chart 1, one can clearly see the contrasting behavior of private and "official" credit growth in the past years. Especially since 2008, when there was a virtual "credit crunch" from private banks, and the state stepped in with stimulus money (read BNDES) to more than compensate the downward trend of private credit.

Chart 1: YoY% Total Credit Growth - Source: Bacen and VOGA.

The following year, 2009, private banks maintained its cautious stance. Only in 2010 can we see a revival of private credit growth in the economy.

The high monetary expansion of 2010, leading to a record GDP growth of 7.5%, culminated in above target price inflation in 2011 as well as higher delinquency rates throughout that year. In addition, Europe and its sovereign debt ordeal contributed to much of the turmoil in the markets. The events of 2011 brought renewed concerns for the world economy.

Under this scenario the private banks in Brazil, always subject to the ruthless test of profit and loss (actually, maybe not that ruthless once you factor in the Bacen's function as a lender of last resort), had no option but to moderate the pace of credit growth in view of an overheated national economy and a tumbling developed world.

But the central planners in Brasilia cannot let the market reassert itself. They must intervene and provide ample and cheap credit. That is precisely what we have witnessed in the last months of last year. Official credit gaining momentum, while private financial institutions refraining from extending even more loans to a leveraging economy.

Though BNDES is the notorious financier of corporations, the federal banks are also having its share. But why must the state interfere with the credit markets? Officially, due to the inability or unwillingness of private banks to provide long term funding to the economy.

The problem with this reasoning is that it sticks to the majority of the businessmen and entrepreneurs. The government is then regarded as the savior rather than the impediment of economic growth.

Independent of one's political inclination, we cannot abstain from making the following point. The conventional wisdom claims the free market cannot (or does not want to) provide long term financing, so that the state must intervene to correct this "market failure".

To those who hold such a belief, we feel impelled to remind them that the present financial system is thoroughly controlled and organized by the state and its central bank. Thus, if such a system is unable to provide long term financing, this is a marked failure of state intervention, and the fault lies wholly with it, and none with the free market.

Therefore, despite conceptually wrong, state credit is justified by an alleged market failure. As we have just argued, such a claim is highly debatable, to say the least. Where there is little room for debate, however, is that the granting of credit by the government is another mighty way of exerting its power over the economy. Quoting once again The Economist, it is the "visible hand of the state".

A worrying trend

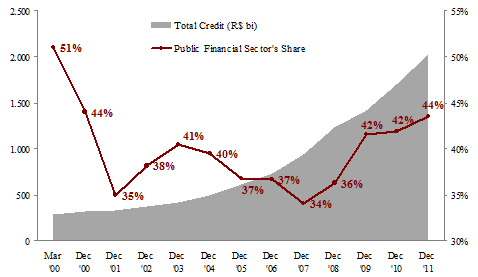

It cannot be denied that this hand is getting ever more "visible", as Chart 2 clearly shows.

Chart 2: Who's leading? - Source: Bacen and VOGA

Public banks are having a bigger share of total credit at levels unseen since 2000, before the end of "Proes". That program's goal was specifically to reduce the presence of the state in banking. To "privatize" banking and, consequently, credit. What we are seeing now is actually a reversal of that trend. In a way, it is a renationalization of credit.

Nevertheless, there are obvious differences from the public bank financing in the 90s and at present. Back then credit was extended mainly to the state governments and to state enterprises. The economic rationale behind those loans was largely absent. Additionally, it functioned as a direct fiscal assistance to the states.

The economic incentives were extremely perverse. A public bank lending to a public company is the perfect combination for waste. The former doesn't care much for being repaid. The latter has little incentive to invest wisely. Both enjoy the always implicit state rescue guarantee.

This time around we face part of those problems. The recipients of credit are private corporations, from large to small, and Brazilian citizens. In contrast with state entities, private companies cannot indulge in reckless spending. But public banks may certainly afford to lend with little prudence.

The main problem with credit provided by public financial institutions is that it can generate malinvestments in given sectors, and risk causing a full blown business cycle, if the expansion of credit is more pronounced.

Instead of an outright waste of capital, as in the 90s, it now risks distorting the efficient allocation of capital in the economy. Therefore, the imbalances may take longer to form, but eventually problems will arise. This is the inevitable outcome when public policy dictates where funds must be invested. Capital misallocation.

Perhaps the most vivid and recent example of a massive misallocation of capital is the American housing bubble that burst in 2006/07. Not coincidentally, government policy was a major contributor to the housing debacle.

Through Freddie Mac and Fannie Mae, two huge government sponsored enterprises responsible for providing cheap home financing, the stated policy of former president George W. Bush to raise the levels of home ownership, and the low interest rates set by the Federal Reserve, an enormous bubble was formed. The effects of which are still being felt in the US.

In Brazil, Caixa Econômica Federal, a public bank, is the main source of home financing, responsible for virtually 75% of all outstanding housing credit. But in comparison to other development markets, there is still a long way for leverage to become a problematic issue. Total credit to GDP is still below 50%, whereas housing credit constitutes no more than 5%. However, the system has leveraged up quickly in recent years. No one better to illustrate this point than the Brazilian households, who are leveraging up quite fast. By looking at Chart 3, we see that the upward trend in debt to disposable income shows no sign of abating.

It must be said the starting point was substantially low. Especially when compared to developed nations. No more than 6 years ago, Brazilian households allocated less than 20% of their income to debt. As of November '11 this figure reached 42.5%. Maybe not a cause for concern at this very moment. But certainly a ratio to watch closely.

Another harmful byproduct of this worrying trend is the collateral damage on the fiscal front. The implicit rescue guarantee may surely inflict budget burdens in the future, precisely what happened in the 90s. Capital injections by the state may be necessary in order to avoid insolvency of public banks. In extremis, depending on the intensity of the credit cycle, even private banks and individuals may be bailed out by the government, the very measure adopted by the US, Spain, Ireland, and the UK (a major culprit for the sovereign debt crisis of 2011 was the massive assumption of private debt by the central governments). But this scenario seems to be a few years away in the case of Brazil.

We leverage, they de-leverage

Speaking of credit cycle and leverage, we bring attention to a McKinsey Global Institute report, issued last month, on the deleveraging process underway in the developed world. Or perhaps, as the report claims, the need to further deleverage.The historical experience suggested the deleveraging process that begun in 2008/09 would be long and painful. The reality is precisely that.

In its study, MGI analyzes the situation of ten mature economies, and how the process of reducing debt exposure is being carried out in each.

Some key findings of the report are:

- deleveraging is still in its early stages;

- US households is better pursuing the debt-reduction path. At least in the case of households. Debt to disposable income has been reduced by 15 percentage points, more than in any other country;

- United Kingdom and Spain are yet to post a significant reduction of debt. The ratio of UK indebtedness has continued to rise and British households have increased debt in absolute terms. In Spain, households have barely reduced debt ratios and corporations continue to carry the highest level of debt relative to GDP in the sample analyzed by the study. They estimate it could take many more years for an orderly deleveraging in the United Kingdom and Spain to finish.

With all the debt load in the system and the forces to cleanse the economy of malinvestments, it is contradictory to have Central Banks in the developed world (especially the Federal Reserve) attempting to force even more debt into the economy. To get "businesses and households to borrow and spend" goes the usual mantra. Eventually the market reasserts itself, despite all state interventions to the contrary. What is certain is that the more the process of deleveraging is prevented the longer it will take.

Summing up

Brazil is on the opposite side of the track. While we leverage up, developed nations de-leverage.A credit cycle in the country is only beginning, as we have argued in previous writings. The main point in this month's Newsletter is that, unfortunately, a large portion of this credit is being driven by the public financial sector. What is more, the share of "official" credit is in fact playing a bigger role (Chart 2).

How this trend will develop in the future we cannot predict, because it is up to politics, not economics.

Will lending standards be eased to accommodate further lending in the housing market? Maybe down payment will be dismissed as no longer necessary, just as lenders did in the US housing bubble. We can only speculate.

However, politics can never overrule economic law. No matter how much credit is created in the system, without prior savings, investments cannot come to fruition. Without production and thus income, the housing deficit cannot be reduced by the mere creation of credit out of thin air.

Much has been said about this so-called housing deficit and the consequent demand for homes. But real demand can only be brought about by real income. Real income increases through higher productivity, which in turn is an outcome of increased investment. For one to invest, one needs to save. The whole process begins with savings. To invert the natural order of things is a recipe for economic disarray.

The late economist Ludwig von Mises once wrote that "economic history is a long record of government policies that failed because they were designed with a bold disregard for the laws of economics". Public banks must, by definition, disregard economic laws. The economic history of Brazil is filled with episodes of mismanagement in public banks. It is discomforting to realize we may be embarking on a new one.

[From VOGA Newsletter]

Comentários (0)

Deixe seu comentário